New FHA is actually established in 1934 following the High Despair, and its own continuous mission will be to perform a lot more people regarding U.S. Thus, its plainly noticeable your interest in FHA financing will come from their capacity to continue mortgages to many somebody trying to buying property. You should remember that this new FHA does not lend money, however, insures loan providers as an alternative.

Pros and cons out of FHA Financing

- No requirement for high down-payment. FHA money try famous for demanding down payments as little as step 3.5%. That is the brand new single biggest adding grounds in order to FHA’s importance in assisting to discover the fresh hopes for owning a home to help you less-than-qualified house.

- Zero dependence on large credit scores. In fact, this new FHA approves money to have properties with credit scores regarding 580 otherwise straight down.

- Zero prepayment penalties.

- No expectation to possess income should be fulfilled. For as long as individuals can show that they can pay off brand new loan (often as a result of a history of costs otherwise highest offers), probably the reasonable earnings house can be considered.

- Particular scenarios in which FHA loan individuals can spend upwards so you’re able to 57% of their earnings on the all month-to-month debt obligations, in fact it is considered exceptionally higher versus obligations-to-earnings ratio requirements out-of almost every other mortgage loans.

Not just manage he has very appealing bonuses to have individuals, but for specific mortgage lenders along with; as they are a federal organization upheld by tax cash, FHA fund fundamentally ensure the capacity to dominate one left loan payments whenever individuals occur to default.

Having as numerous professionals as they feature, you will find reasons why they have not been accompanied since the common opportinity for mortgages.

- The MIP and you can next payments donate to as to why FHA fund are most likely getting more expensive than simply old-fashioned finance. And additionally, instead of aforementioned, FHA insurance fees can’t be canceled immediately following 20% away from house collateral try achieved; this really is an extremely high priced and you may extremely important pricing to help you take into account. When anyone speak the favorable virtues out-of FHA, it certainly is combined with brand new ‘catch’ a while later – the insurance repayments. FHA insurance is have a tendency to unavoidable without paying off of the loan totally.

- They give away apparently faster loans than just if not. Individuals seeking higher priced house sales may want to evaluate old-fashioned finance as an alternative.

- Borrowers with excellent borrowing are more likely to get better prices out of old-fashioned fund.

- There are particular limits in order to properties that be eligible for FHA finance while they need see standards such as first health insurance and security.

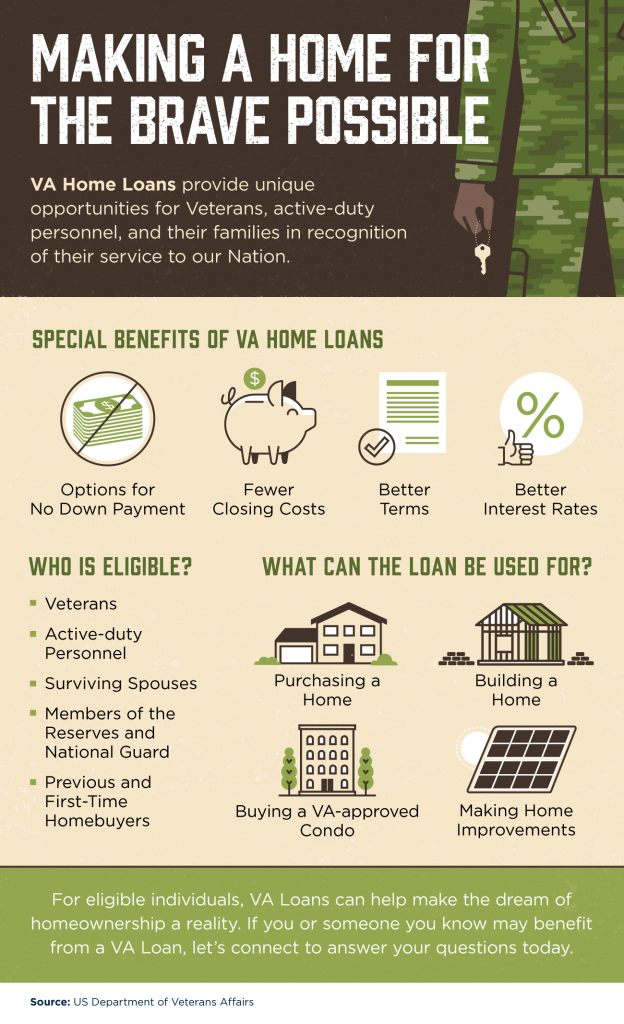

As with any other large monetary decision, take the time to consider all choice. If you are FHA finance are a practical solutions, conventional financing are top for many people, including in the event that down-payment is over 20% otherwise he’s got advanced level credit scores. Experts and you can similarly applicable anyone must look into Va loanspare costs offered of the additional loan providers.

Home Value

The fresh Agencies regarding Construction and Metropolitan Innovation (HUD) is the organization one establishes particular assistance to possess FHA obligations-to-money percentages and you can formulas always carry out the risk of per potential house that borrows FHA funds to possess household requests. To determine the domestic cost off an enthusiastic FHA loan, excite use our home Affordability Calculator. On the Financial obligation-to-Earnings Proportion drop-down possibilities, you will find a choice for FHA financing.

It becomes instantly obvious that FHA finance have the really strict debt-to-income ratio conditions. After all, this new FHA was fundamentally designed to take in the chance intrinsic when you look at the supplying of a lot money that might be defaulted at any time.

But not, discover exceptions which is often made for consumers whom don’t follow the front or right back-end percentages off 29% and 43%, correspondingly. The fresh new HUD can give mortgage brokers flexibility to help you approve consumers once the long since lenders offer evidence of significant compensating activities. A minumum of one is typically adequate to meet the requirements consumers. These compensating products is:

Prepayment

There’s no prepayment penalty to own FHA loans, which produces financial feel for many FHA consumers so you’re able to complement a keen FHA loan with increased money. not, i encourage they on condition that the financial predicament allows for they, and all of our calculator may help. Into the Significantly more Options type in area of the calculator was an More Repayments point to type in monthly, annual, or solitary payments. Make use of the results to find out how far the size of the fresh new mortgage are slash quick.

FHA 203K Money

An enthusiastic FHA 203(k) loan allows borrowers to finance both the get and you will repair out of a primary home or even finance this https://paydayloanalabama.com/auburn/ new renovation of their present family. Essentially, permits individuals purchasing and you can re-finance property that needs works and you will move new renovation will cost you for the home loan.

FHA 203k fund bring a few of the same factors just like the typical FHA mortgage, such as easier degree to own finance, highest insurance fees, and you can a tiny lingering commission. The completion of advancements should be accomplished within this six months. FHA mortgage loans are moved to the a keen escrow membership and you may paid back to help you contractors just like the developments occur. At least $5,000 must be lent and you can restriction limitations are set by the FHA one to differs considering metropolitan areas. Similar to normal FHA finance, they have a tendency as sufficient for most parents to get property that commonly decked-aside mansions. Funds may also be used to own short term property when you find yourself advancements is becoming created for up to half a year.

Truth be told there and additionally is available a small form of the newest FHA 203k titled new Streamlined FHA 203k made especially for straight down credit numbers one are canned a lot more easily.