With respect to building a little Household, labeled as an equipment Dwelling Unit (ADU), information the capital options is a must. Just the right investment strategy produces a primary improvement when delivering their ADU project to life, whether you’re planning to match relatives, build rental money, or boost your property’s value. This guide was designed to make it easier to navigate the new selection of financial support options available, organized from the customers character to suit your unique financial situation.

House collateral is the portion of the possessions that owner actually is the owner of outright. Because you reduce the loan, the equity expands. Your property equity plus increases when your market value of your household grows due to developments otherwise market standards.

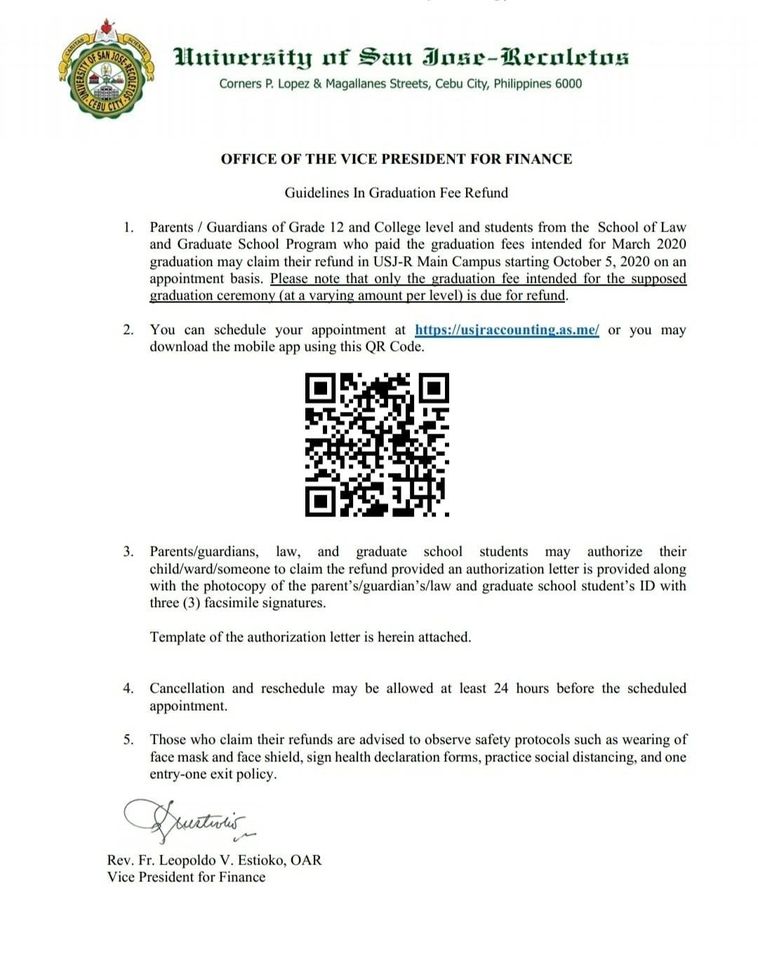

Figuring family security loans Candlewood Isle is easy: you subtract the amount you borrowed from for the people mortgages or finance protected by the domestic on most recent ple, if the house is currently really worth $600,000 on the market, and you have a home loan balance out of $eight hundred,000, your home security might possibly be $two hundred,000.

So you can correctly dictate the home’s economy really worth, a loan provider commonly purchase a specialist assessment, that takes into account recent conversion out of comparable qualities on the urban area, the condition of your residence and field fashion. Rather, on the web valuation tools provide a crude imagine but could not always capture brand new nuances of your own local markets or certain improvements made to your residence. Contemplate, your own guarantee is also vary throughout the years with changes in the marketplace value of your residence so that as you make payments in your mortgage.

Shortly after calculating your property collateral, additionally it is easy to assess the home’s financing-to-really worth ratio LTV getting brief. LTV is the amount you owe on one mortgages otherwise loans safeguarded by your household split up by latest ple over, the latest LTV is approximately 67% ($400,000 divided of the $600,000). To help you maximum its chance, really loan providers require your amount your debt towards any mortgage loans otherwise fund protected by your family because the a percentage of one’s residence’s market price doesn’t meet or exceed a particular endurance, which is usually 80% otherwise ninety%, although some capital choices are significantly more lenient although some aren’t associated with your existing home equity, as the we shall explore much more information below.

For those home owners that fortunate to possess nice guarantee within their home, the easiest way to money a small Family design enterprise is actually locate financing which is secured of the you to definitely home guarantee. Choice include HELOCs, home security funds and cash-out refinance, that are said lower than.

Household Collateral Personal line of credit (HELOC)

Good HELOC is actually a famous and you can productive selection for homeowners just who has actually built up high guarantee in their number 1 household. It’s a beneficial revolving personal line of credit, and that means you mark just the cash you need, as it’s needed, and can repay it within the a timetable that easily comply with your debts.

That it resource station enables you to borrow secured on the worth of your residence which have high autonomy and usually comes with glamorous appeal prices considering the mortgage getting secured by your assets. This is often the original alternative i encourage for some of people with enough household guarantee.

Most appropriate For: property owners who require flexible entry to finance and will leverage the equity in their home to invest in their Small Belongings. This is exactly a beneficial when your most recent ongoing mortgage speed in the the business try faster glamorous versus homeowner’s current home loan.

Home Security Funds

Exactly like HELOCs, home security funds allow you to borrow against this new collateral during the your residence however, started as a lump sum and you will typically with a predetermined interest. This is certainly useful getting investment the building of a little House or apartment with a very clear funds. Yet not we would suggest that you plan for most most costs as well, when figuring the size of the loan.