- FHA Financing Constraints: Dealing with the usa Company out-of Homes and you can Metropolitan Advancement the restriction count you could potentially obtain depends on the expense of housing from inside the a specific town. Getting discount parts new maximum try $420,680 and for highest prices areas the brand new restrict is actually $970,8000. This may vary because of the state and you may county.

- Residential Use: FHA fund are just relevant for residential properties and won’t end up being provided so you’re able to financing or vacation services.

- FHA Check: Just before qualifying to have an enthusiastic FHA mortgage an enthusiastic FHA appraiser often gauge the possessions centered on a set of safeguards recommendations.

There is significantly more standards that are added because of the loan providers with the ideal ones required for an FHA financing, it is critical to seek advice from multiple loan providers to determine what financial will probably be your best match.

Virtual assistant Finance | 580-620

Since the Virtual assistant guarantees their financing facing loss, lenders offer Va fund during the low-rates, usually these are the reasonable rate of interest loans offered.

Va money plus don’t require a downpayment which means mortgage should be 100% of the home price. In buy to obtain good Va home mortgage a certificate out-of https://clickcashadvance.com/personal-loans-nj/new-brunswick/ Eligibility (COE) is needed.

USDA Funds | 620-640

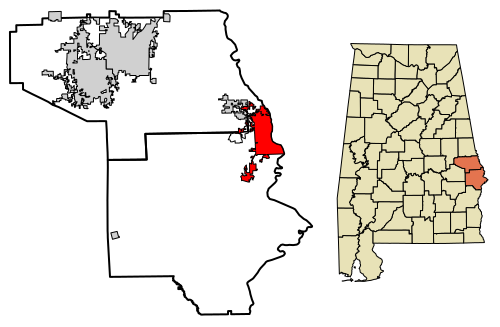

USDA mortgage loans are around for residential property outside densely inhabited aspects of the us. Even though, USDA finance are applicable to over 90% of your own land in the usa.

This can include outlying section, small places, and lots of suburbs, however, conditions can be produced to own home buyers with extenuating items. USDA loans such as Va funds do not require a down-payment, as well as on average the interest pricing shall be 0.5% less than traditional money each time.

Jumbo Financing | 700+

Jumbo money is actually for home buyers whose mortgages are too large toward local home mortgage restriction. There is no specific credit history importance of an effective jumbo home loan, however, large score may become acknowledged.

Most loan providers need a credit history out of 700+ in order to be eligible. Virtual assistant Jumbo financing can be offered at credit ratings regarding 640 and you will significantly more than. To be assigned a reduced interest it’s best so you can trust trying to find a get regarding 700+ range.

Jumbo loans are used for a number of assets models, and now have come useful for first homes, as well as amusement services like vacation land, or features one to act as a financial investment.

In the current economic climate it. is likely to be which you come across your self losing in short supply of the desired credit or Fico rating required for a mortgage. However all of the is not forgotten, you could potentially follow certain assistance which can definition how to enjoys the financing to shop for a property.

Compliment of following the a number of simple actions you could potentially improve your borrowing score by the a lot in a short span of time. Several things which can help change your credit history are: looking after your balance to the playing cards lower (below 29%), investing all of your debts timely, and starting the latest profile that may statement beneficially on the borrowing from the bank bureaus.

Following this it is critical to let your of use accounts adult inside an effective standing, with a lot of time reputation of on time payment background and you can in control incorporate will receive your credit rating improving very quickly.

- Personal debt to Income Ratio (DTI): To calculate DTI make sense your entire monthly personal debt money and you can divide the full by terrible quantity of income you have made each month and multiply it by 100 having a share. To meet the requirements your DTI should not be any bigger than 50% with a perfect in the fresh new 40%-45% diversity.