Artificial cleverness feels advanced however it is already getting used within large four banking institutions. ( ABC Information: Alistair Kroie )

In short:

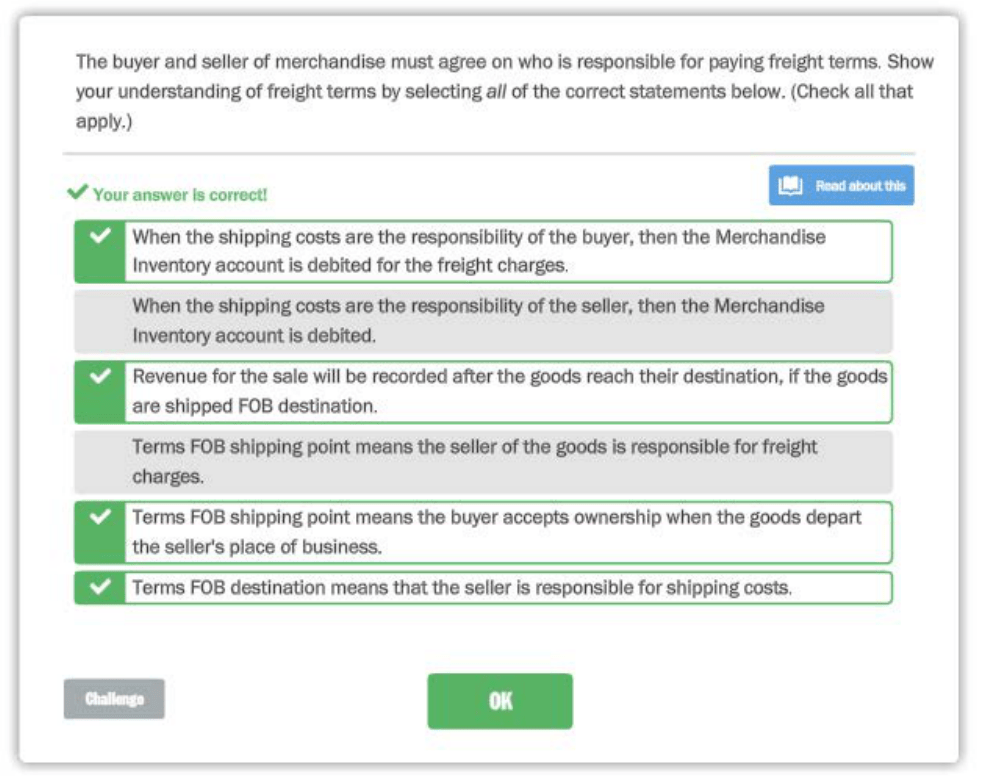

Australia’s big financial institutions is actually increasingly using fake intelligence, that have AI active in the home loan approvals processes through file confirmation and you may summarising consumer files.

ANZ claims using AI incisions certain opportunities out-of many hours to help you “mere seconds”. NAB employs AI in order to analyse the new ’emotional sentiment’ of customers mobile calls

What exactly is next?

The newest Fund Markets connection alerts tens of thousands of call centre work you will definitely feel forgotten since the part off AI grows, if you’re banking companies argue the brand new efforts might be created, that have AI because the good ‘co-pilot’.

During the 1995, American talk tell you server David Letterman performed a now-iconic interview having Microsoft originator Statement Doorways, in which the guy requested your to spell it out which “web sites issue”.

Gates attempts to identify characters and just how leading edge the online was – prior to Letterman claims that if the guy read you can watch a great baseball games go https://paydayloanalabama.com/hackleburg/ on the online: “I just said to me, do radio ring a bell?”

Letterman was purposely flippant, however the interview was also informing about precisely how anybody hadn’t yet knew exactly how seriously the web based perform change our lives.

“It is reasonable to declare that while the there clearly was possible with AI, it requires sometime prior to i will be good enough confident that individuals normally control for risks in an effort to handle that safely during the size,” Mr Comyn listed from the bank’s yearly general fulfilling inside Oct.

AI spiders you will change tens and thousands of call center experts

CBA is one of the primary big four finance companies to come away in public places and you can state it is trialling a great ChatGPT-design AI chat bot in call centres, that could exchange tens of thousands of local call center professionals.

It is early days yet to understand an entire feeling away from occupations losses, whilst Financing Sector Commitment and you will skillfully developed assume inside the financial telephone call centres by yourself, brand new impact will be from the thousands.

And people risks Mr Comyn describes is actually astounding, especially when it involves servers decision making throughout the home loan software.

But CBA is not by yourself in the thinking about the way it can explore AI to simply help the experts ideal answer customer phone calls, perform protection inspections and much more rapidly determine data files utilized during the mortgage software procedure.

The big five lender bosses you to ABC Information spoke to relayed how they are generally creating eg opportunities which have AI.

Nonetheless they was basically short to point out these power tools were there to simply help their staff for making monetary choices, not sign-off on them.

ANZ’s master technology administrator Tim Hogarth states AI happens to be providing ANZ group quickly be certain that files such shell out slides and you may evaluate state-of-the-art mortgage agreements.

“AI can now help us in reality get information out of data files and extract all that meaning and you will reducing the amount of day it requires regarding countless hours, as a result of both moments,” Mr Hogarth claims.

“Including, it could make it easier to know every one of these memberships which you have compiled over time and provide you with tips on what you might should do that have men and women.”

AI already confirming financing documents, so how well away try bot mortgage approvals?

Given that AI will get best on performing employment you to individuals perform and you can getting more working in extremely important conclusion – like whether to approve home financing Mr Hogarth believes you to definitely “specific perform will go away, brand new services is available in”.

The lending company recently unwrapped what it phone calls its ‘AI immersion centre’ in the Docklands, Melbourne, that’s degree step three,000 specialists on precisely how to fool around with AI to do its operate.