New Homeownership Difficulties inside California

If you’re an occupant inside Ca dreaming of homeownership, you probably come strike which includes challenging amounts. From inside the 2024, new median house price during the Ca is at around $838,two hundred, which is almost double the federal median household price of $439,455. California’s housing industry enjoys viewed a price increase around six.9% versus earlier year, just like the federal field experienced an even more modest increase away from cuatro.1%.

For these about San francisco, the challenge is additionally harder, with average home values topping $one million. This is no quick feat, particularly for first-day homeowners.

And make issues even more difficult, mortgage pricing have increased greatly off their all-go out downs in the 2021. At the time of 2024, rates are still greater than many perform promise, and you will forecasts reveal they could not drop-off significantly about close coming. Regardless of this, there are a selection from apps and methods that can assist you get their feet throughout the home.

Here is the Good news: Ca Also offers Direction having Very first-Date People

California has some quite complete very first-time homebuyer software in the united states, designed to let renters and you may renters like you beat monetary traps last but most certainly not least individual a home.

Such apps will offer smaller off payments, straight down interest levels, and help with settlement costs. However, when planning on taking advantageous asset of these types of software, you ought to see specific conditions. Let’s break down all you have to qualify.

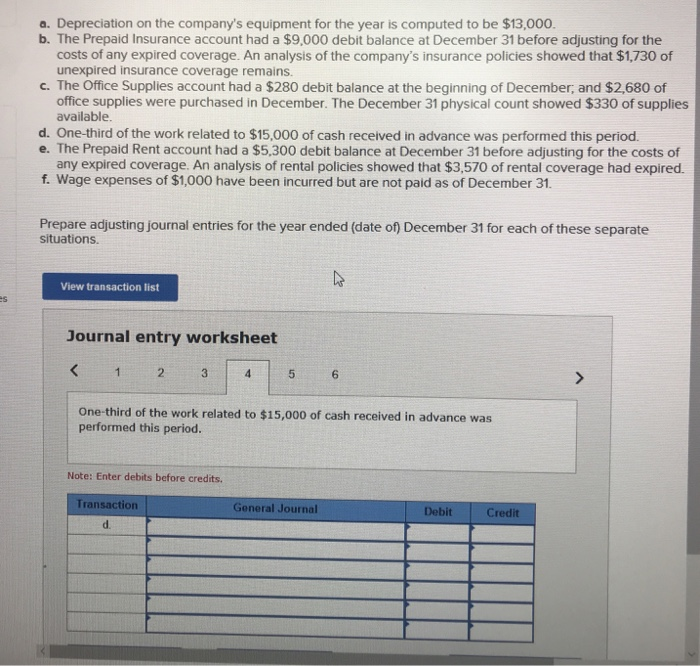

step one. Debt-to-Earnings Ratio (DTI)

Their DTI https://paydayloancolorado.net/rico/ ratio is essential from inside the determining your ability to help you qualify to have a home loan. This ratio ‘s the portion of their monthly earnings used on loans costs, in addition to handmade cards, college loans, and vehicles costs. Very loan providers like good DTI ratio out-of 43% otherwise shorter, while some applications you are going to undertake highest percentages for those who fulfill other requirements.

dos. Credit score

Your credit rating will likely determine not simply if you meet the requirements for a financial loan, but in addition the regards to a loan, like the interest. A good credit score generally falls regarding directory of 670-739, when you’re things over 740 is known as excellent.

Should your rating is lower, don’t worry-there are borrowing from the bank improve measures you could potentially implement. Simple steps including paying down an excellent balances, disputing errors on the credit history, and you can keeping a low borrowing use ratio is alter your rating.

step 3. Money Restrictions

Of numerous Ca applications provides income restrictions, meaning your loved ones earnings have to be lower than a particular threshold in order to be considered. These limits will vary of the condition, therefore it is essential to look into the income limit for your specific area. As an instance, money limitations to own software during the higher-cost nations such as the San francisco are often more than in the rest of the state.

cuatro. First mortgage

In order to be eligible for this type of programs, you must be a first-time homebuyer, recognized as somebody who hasn’t owned a property in the past 36 months. This type of applications are designed to help those people who are and work out its very first big step with the homeownership, so even if you used a property, you might still be considered under the proper standards.

5. Number one Quarters

The us government direction applications inside Ca try worried about helping anybody buy residential property they intend to inhabit full-big date, maybe not funding functions or vacation property. The house or property you are purchasing should be much of your household.

6. Seasoned Position

When you’re an experienced, you are in chance! Ca has actually particular programs, for instance the CalVet Home loan System, tailored to help veterans buy homes which have lower rates and you will beneficial words. Such advantages are included in the fresh country’s commitment to helping those who’ve offered our nation secure the little bit of the fresh new Western Dream.

2024 Style: Way more Flexible Choices for First-Date Buyers

When you look at the 2024, the genuine property markets features modified to address new constant value activities, particularly for earliest-time homeowners. Versatile financing selection are very so much more offered, providing lower down percentage conditions, closing prices guidelines, and even grants in a few higher-consult components.

As well, of several loan providers are in fact giving adjustable-speed mortgages (ARMs) as an option to the conventional 31-12 months fixed-rate home loan. If you’re Arms feature so much more risk (rates of interest can also be change), they supply down 1st rates of interest, that is a casino game-changer to have very first-time consumers making an application for into the expensive avenues like the Bay Urban area.

The way the Cal Representatives Can help you Browse the method

On Cal Agencies , we know exactly how challenging the new homebuying process are-especially in Ca. Our team deals with earliest-date consumers so you’re able to navigate the maze off bodies apps and you will financial support available options to you.

We provide a no cost Real estate 101 Category to-break along the whole process, off taking pre-recognized to own a home loan in order to closing on your own fantasy home. Whether you’re simply undertaking their homeownership journey otherwise are quite ready to buy now, we offer custom recommendations based on your unique financial situation.

While doing so, i lover with trusted loan providers whom focus on earliest-go out homebuyer applications, therefore we can connect your toward greatest alternatives for the requires. For every lender has its benefits and drawbacks, and you can the audience is right here so you’re able to have a look at which is the top fit for your.

Join All of our A residential property 101 Category and begin Your Excursion

If you are willing to use the step two to your homeownership, join you for the totally free Home 101 Classification. The category covers all you need to see, out of skills your credit rating in order to qualifying getting first-go out homebuyer programs, therefore you can feel confident in and come up with told choices.