ICICI Securities Ltd. (I-Sec). Inserted place of work from We-Sec is at ICICI Securities Ltd. – ICICI Campaign Domestic, Appasaheb Marathe Marg, Mumbai – 400025, Asia, Tel Zero: 022 – 6807 7100, Fax: 022 – 6807 7803posite Corporate Broker Permit Zero.CA0113. Insurance policy is the subject matter-of solicitation. ICICI Bonds Ltd. will not underwrite the risk or act as an insurance carrier. The brand new post includes merely a sign of the new safety given. To get more info on risk issues, terms and conditions, requirements and you may exclusions, excite browse the conversion brochure cautiously ahead of finishing a-sale.

Responsible Revelation: In the event you get a hold of one protection insect otherwise susceptability into the all of our program otherwise cyber-symptoms into the our very own trading platform, delight declaration they to help you or e mail us on the 022-40701841 to aid all of us strengthen all of our cyber shelter.

What is actually EMI?

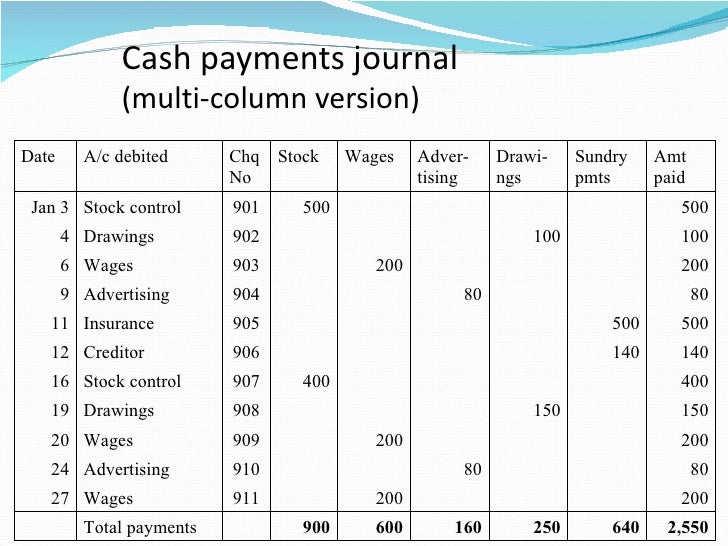

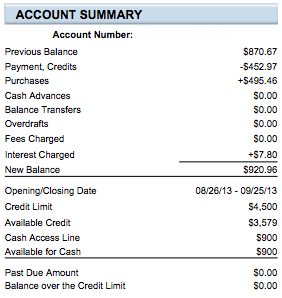

They comprises dominating installment and you can desire. As a consequence of EMIs, borrowers pay their loan amount more a predetermined period inside the equal instalments. For every instalment covers part of the principal number in addition to the newest accumulated attention. The interest part decreases over time since the dominant component grows. Using a finance calculator can help you understand your month-to-month instalment number before applying for the financing.

EMI interest hand calculators describe loan fees to have consumers by offering good arranged fees schedule. Loan providers estimate EMIs centered on issues such as loan amount, rate of interest, and you will period. EMIs render individuals with a definite comprehension of the month-to-month financial personal debt to the mortgage cost. Month-to-month EMI calculator is a superb solution to bundle their cost before you even apply for the loan.

Ideas on how to calculate loan EMI?

So it EMI algorithm exercise the fresh fixed payment expected to repay an amount borrowed over a specified period, because of the interest. It’s used by EMI hand calculators to have EMI computation so you can guess money accurately.

How to use an EMI calculator?

- Choose your loan style of

- Go into your favorite loan amount.

- Input the interest rate provided.

- Establish the mortgage tenure in the weeks otherwise years.

The latest calculator usually calculate the EMIs within this a couple of seconds. The internet EMI calculator along with suggests the newest review of the principal and attention number when you find yourself figuring the latest EMI as well as the total cost regarding borrowing from the bank.

Items affecting the latest due amount

Principal number: The fresh new lent share privately influences the entire due, with higher numbers leading to larger repayments. Borrowing from the bank even more may also impression qualifications to have funds otherwise affect the borrower’s debt-to-money proportion, potentially affecting upcoming financial conclusion for example obtaining a lot more borrowing or mortgage loans. Playing with calculators available, you should check yours loan qualifications effortlessly.

Rate of interest: Personal loan interest rate significantly has an effect on the amount due, having large prices increasing focus servings out of payments. Understanding the difference in fixed and you will adjustable interest rates is essential, since the alterations in rates may affect payment wide variety, impacting the brand new borrower’s capability to create funds effortlessly and you may possibly leading so you can economic filter systems.

Financing tenure: The new duration has an effect on the complete due, that have stretched tenures potentially decreasing monthly premiums but broadening overall attract, resulting in increased overall due. Going for the ideal period concerns controlling affordability to the desire to do away with appeal costs, requiring careful payday loans Battlement Mesa consideration of financial requires and you will restrictions.

EMI volume: Payment frequency (monthly, quarterly, an such like.) impacts the complete due. Opting for more frequent repayments get get rid of attract costs over time, however it is essential to make certain structure with cashflow and cost management. Straightening EMI frequency having income acknowledgment activities can be enhance installment methods and you will improve financial balances on loan title.

Prepayments: A lot more repayments for the the principal reduce steadily the complete owed by detatching the fresh new an excellent harmony and then desire. Leveraging windfalls or extra money having prepayments can accelerate personal debt fees, protecting towards attention will cost you and you may probably reducing the mortgage period, delivering monetary freedom and you can comfort at some point with increased cost skill.