Simply how much home loan can i log on to my personal paycheck? Whenever you are a great salaried staff therefore intend to individual property, this is the basic matter one to comes up in mind. This article will demonstrate just what section of your own income represents if you’re calculating qualifications, what are the well-known income slabs & their qualifications number, what are the additional factors inside your qualifications lastly just how easy its to try to get home financing.

To find one’s home is actually a primary step for many people when you look at the finding a sense of settledness. This is certainly specifically a status part of Indian culture. not, for some the newest salaried people, real estate prices are past their started to. Simply after faithfully building its savings do they really eventually get this fantasy possible, will afterwards in daily life. And here availing of a mortgage can be catapult on your own to achieve the homeownership fantasy at an early age.

Discover your own salary:

Estimating salaries is also encompass using data representing both disgusting otherwise websites (in-hand) income. Hence, you will need to understand the difference between gross and you can web salary. For the reason that economic schools tend to consider the internet element of a person’s income while visiting their residence mortgage qualification. Income construction differs all over individuals organizations. Although not, its generally split up into next section:

- Earliest Salary

- Allowances Such Scientific Allotment, Leave Travelling Allocation (LTA), House Lease Allowance (HRA), Almost every other Allowances, etc.

The aforementioned areas means this new gross area of the paycheck. Although not, this is simply not the past amount your staff member takes household. There are some required write-offs about terrible full. Talking about deductions into the Staff Provident Loans (EPF), Taxation Deduction on Origin (TDS), Professional Taxation, etcetera. New write-offs done, the remaining number constitutes the net income, and this group normally call its during the-give spend otherwise paycheck. Mortgage qualification formula takes into account an enthusiastic applicant’s internet income alongside most other circumstances.

How much cash Mortgage Do i need to Log on to My personal Paycheck?

As a rule out-of thumb, salaried men and women are entitled to get home fund as much as doing 60 times the internet monthly income. So, if the web month-to-month paycheck are ?40,000, you should buy home financing to as much as ?24 lakh. Simultaneously, for folks who earn ?35,000 monthly, you can buy around doing ?21 lakh. An exact way of going to qualifications is by using good mortgage qualifications calculator which takes under consideration various other affairs besides internet month-to-month earnings. To have a quick resource, you will find indexed down common web monthly earnings slabs and their corresponding number qualifications. These philosophy had been computed using the HomeFirst Mortgage Eligibility calculator and when the next conditions:

Note: If there’s more 1 generating user in a family, the online monthly earnings of all earning participants might be combined to arrive at a top financial qualifications matter.

Other variables Affecting Mortgage Qualifications:

- Age: Mortgage brokers are available for candidates between 21 in order to 55 many years old, but generally, monetary institutes will approve mortgage brokers to your more youthful population. The reason is that young applicants have a longer working lifestyle. Hence, the possibilities of fees away from mortgage brokers try highest. About 50s, that ount as well as a shorter years.

- Company and you may Work Feel: People doing work in a reputed organization will rating home financing because they’re considered more secure. This provides depend on away from timely percentage regarding EMIs. Simultaneously, while involved in a reputed team, then you might qualify to take a high amount opposed so you’re able to individuals working with not reputed providers when the almost every other circumstances are considered equal. Likewise, your projects sense speaks a great deal about your balances and you can acts once the a positive tip on your own software.

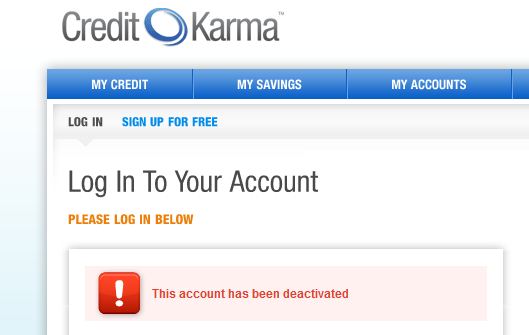

- Credit rating: One of the extremely important things in choosing your own qualification can be your earlier in the day payment reputation funds which is also seized of the credit history . Even though you secure an extremely handsome income, a poor credit rating can also be adversely effect your chances of getting a mortgage. Essentially, financial schools like a credit history of greater than 650. A credit history a lot more than 750 can also leave you an upper hands so you’re able to price for down mortgage rates.

- Present Loans (labeled as Fixed Obligations so you’re able to Earnings Proportion otherwise FOIR): Financial education started to home loan number qualification away from a guy only shortly after considering its established debt regarding EMIs and you will a fantastic fees regarding almost every other funds which they might have availed particularly a car loan, consumer strong mortgage, personal loan, playing cards, etc. Loan providers prioritize in control credit methods, for this reason they evaluate internet salary to be sure in balance money and EMI to own home loan consumers. FOIR is the portion of the sum of the All of the Established Monthly Debt so you’re able to one’s net month-to-month money. Normally, it needs to be lower than 50% having qualification.

- LTV (Loan so you’re able to Value): Even although you provides a higher financial qualification in terms of your web monthly earnings, financial schools just funds up to 75% in order to ninety% of your total cost of the home. This is accomplished to be certain he has got enough shield to help you liquidate the root advantage & recover their matter in case there is a standard.

- Property’s Courtroom & Tech Recognition: In terms of lenders, health of hidden advantage is most important. Monetary Institutes possess dos chief review conditions to your assets one the latest candidate is about to purchase. The original one is to examine this new judge strings of property to determine an obvious label & ownership therefore the 2nd a person is to choose the market value of the home. Both these recommendations are done by separate solicitors & valuers who’re appointed by you to definitely financial institute.

Get Financial:

Just before releasing a find the fresh fantasy house, you have some idea regarding mortgage count your could be qualified to receive according to the salary. This will help to make a budgetary decision about the possessions you intend to purchase. You can examine the house mortgage qualifications calculator in order to estimate just how much count youre permitted score. Given that house is finalized, you can travel to the new HomeFirst web site and you will fill-up the inquiry form for a visit back from our Counsellors. You could send this informative article understand more and more home loan terms and conditions or this article to own files needed for financial programs

To the a lot more than suggestions in position, it’s possible to answer the question regarding exactly how much house loan one to can get on their/their own salary. This will help to all of them grab a massive step into the to shop for the dream domestic.