Monthly Homeloan payment

Your own homeloan payment to have a good $222k home will be $step one,480. This is exactly according to a good 5% interest rate and you can a beneficial 10% deposit ($22k). This includes projected assets taxes, possibilities insurance policies, and you will mortgage insurance fees.

Income You’ll need for a great 200k Financial

You will want to create $74,006 per year to pay for a great 200k mortgage. I base the income you need with the a beneficial 200k financial toward a cost that’s 24% of your monthly income. In your case, your own month-to-month earnings might be in the $6,157.

You could be conventional or a good a bit more aggressive. You’ll change it within how much house do i need to pay for calculator.

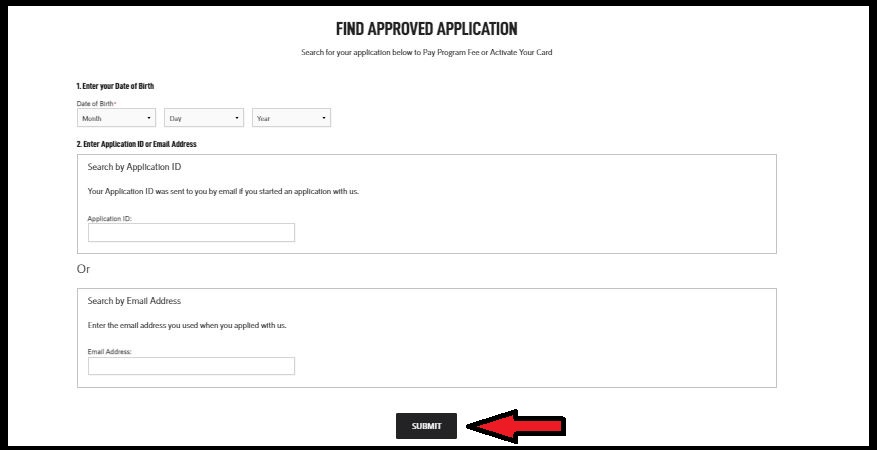

Do the Quiz

Utilize this enjoyable quiz to determine how much cash household We are able to afford. It takes only a short while and will also be in a position to feedback a customized research at the bottom.

We will definitely commonly overextending your finances. You’ll also features a comfortable count on your checking account after you get your home.

You should never Overextend Your financial allowance

Banking institutions and you may real estate agents earn more money once you pick a more expensive household. Normally, financial institutions usually pre-approve your for the most you could possibly pay for. Right out of the door, earlier touring residential property, your budget is offered on the maximum.

You will need to be sure that you is actually at ease with your monthly payment and also the amount of money you’ll have left during the your bank account once you purchase your house.

Compare Home loan Pricing

Make sure you evaluate financial costs before you apply for a beneficial financial loanparing step three loan providers could save you several thousand dollars within the a couple of numerous years of your mortgage. You could contrast mortgage costs on Bundle

You will see newest home loan pricing or find out how home loan pricing today enjoys trended more than last few years toward Package. We display screen each and every day home loan prices, trends, and you may dismiss points getting fifteen 12 months and you may 30 season home loan points.

- Your credit rating is a crucial part of your home loan techniques. If you have a high credit score, you will have a better chance of taking good approved. Loan providers are far more comfortable providing home financing percentage one is actually more substantial percentage of your own monthly earnings.

- Home owners connection fees (HOA costs) can impact your house to shop for fuel. If you undertake a property who has got higher organization charges, it indicates you’ll want to favor a lowered charged where you can find to decrease the dominating and you may notice payment adequate to provide room toward HOA dues.

- Your most other loans payments can impact your home funds. For those who have lower (or zero) most other loan money you can afford going a small highest in your mortgage payment. If you have highest monthly installments to other fund including auto repayments, figuratively speaking, or handmade cards, you’ll want to back the month-to-month mortgage payment a little to ensure that you have the budget to pay all bills.

Once upon a time, your had a need to create an excellent 20% down-payment to pay for property. Today, there are many different financial products which will let you make good much less downpayment. Here you will find the down-payment conditions getting prominent home loan products.

- Traditional loans wanted a 5% advance payment. Specific very first time homebuyer programs succeed 3% off money. A couple advice are Family In a position and Domestic You can easily.

- FHA funds require an effective 3.5% downpayment. In order to qualify for an enthusiastic FHA mortgage, the property youre purchasing must be the majority of your quarters.

- Va fund want an excellent 0% deposit. Energetic and you will retired armed forces staff is generally qualified to receive an effective Virtual assistant mortgage.

- USDA financing need a beneficial 0% downpayment. These are mortgage loans that are available within the outlying aspects of the fresh new nation.

What are the strategies to buying a house?

- Play around with many mortgage hand calculators. Begin getting comfortable with loans New Canaan all expenses associated with to acquire an excellent household. Most people are shocked after they find out how far additional possessions taxation and you can homeowners insurance increases their payment every month.

- Check your credit score. Of several financial institutions usually now make suggestions your credit score free-of-charge. You may play with an application particularly borrowing from the bank karma.