- Show post:

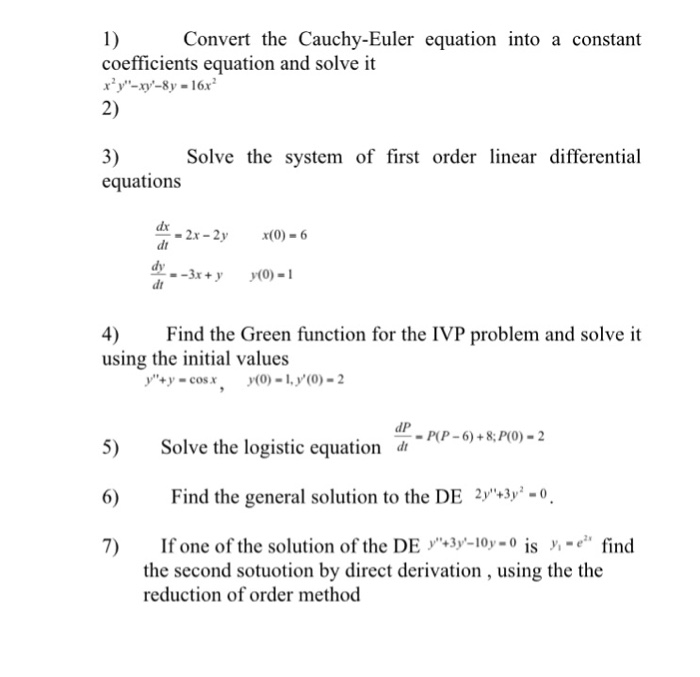

Basic Financial Put Program (FHLDS) standing to possess FY 2022-23

Pleasing expands was revealed in the 2022-23 Federal Budget, making it possible for significantly more earliest homebuyers the means to access this scheme! The original Mortgage Deposit system has been theoretically rebranded the initial House Verify and you will away from , the number of placements toward reduced put strategy will increase to 50,000 places. Following this three year period how many placements will revert to thirty five,000 a year.

- thirty five,000 metropolises a-year to your Very first Domestic Guarantee (formerly Basic Mortgage Put Plan) having eligible earliest home buyers hit the market having a 5% deposit no LMI.

- 5,000 places annually to the freshly announced Regional Household Be sure to have qualified homebuyers to order a new household inside a regional place that have a 5% deposit with no LMI.

- 10,000 locations a-year towards House Make certain getting qualified single mothers to invest in a property which have a two% put with no LMI.

What is the Earliest House Be sure (Formerly Earliest Mortgage Put Plan)?

Brand new government’s strategy was designed to allow simpler and you will less availability to your possessions since First Home loan Deposit Plan (FHLDS) – today rebranded The initial Domestic Verify step one – allows first-time people the opportunity to purchase a house having a deposit off as low as 5%, while avoiding lenders’ mortgage insurance policies (LMI). Really finance companies and loan providers need at least put out of 20% of your own property’s value for the borrower becoming exempt out-of LMI. The brand new strategy lets first homebuyers whom cannot reach so it tolerance to take out a loan whether they have conserved at the very least 5% of worth of the house he or she is to buy. The federal government commonly underwrite the borrowed funds with the intention that borrowers do not need to pay LMI.

Why does it really works?

Just be sure to apply for this new strategy as a consequence of certainly the fresh scheme’s performing lenders, or authorised representatives such as for instance a mortgage Choice agent and have indicated your own eligibility. While you are approved, you’ll be able to sign up for home financing which have a lender therefore the regulators acts as your guarantor. Though your own financial have a tendency to still do their typical inspections on the finances, this will make it simpler to rating a loan devoid of stored having good 20% deposit.

Always, in the event the a lender chooses to approve that loan with in initial deposit out-of below 20%, they’ll need to have the debtor to spend what exactly is entitled loan providers financial insurance policies (LMI). This is a kind of insurance rates your bank removes so as to shelter the risk of new borrower are incapable to settle the mortgage. As government is actually providing since the guarantor for the mortgage, you don’t need to toward lender to obtain insurance policies. LMI could be extremely pricey, according to the sized brand new put, how big is the borrowed funds, additionally the terms of the lender. The us government says you could save yourself to $10,000 towards LMI, but the count you probably save your self might possibly be dependent on the fresh ins and outs of your loan. Together with, should you have prior to now wanted to help save to possess a great 20% deposit, you will not experienced to spend LMI, anyhow.

By taking aside a home loan under the system, you will then receive assistance up until your own loan’s balance are reduced to less than 80% of your own value of your home during the purchase. not, for individuals who refinance the loan, sell your home otherwise escape, so long as qualify for service. I f you are refinancing your residence and you however are obligated to pay more 80% of value of the house or property, you will likely have payday loan Windsor to pay the cost getting lenders’ financial insurance rates with your the new lender.