Hmmmm . so if its well worth more than the loan equilibrium owed, is there a reason the reasons why you did not sell it early in the day to declaring bankruptcy? Having said that, my think is that, should you decide built a potential consumer, you are able to get in touch with the lender and give an offer off business. Just remember that , the title stays with the deed until the domestic comes and/or bank forecloses in it.

Zero. Which have a default and launch with the 1st financial, you will no longer have need for our home to use given that collateral when it comes to mortgage. Perhaps not unless you pay the first mortgage as well as have new action free and obvious.

If for example the OP is actually newest during submitting BK eight he is able to continue to reside and pay for the borrowed funds and sustain brand new collateral when you look at the Fl (first house only – endless collateral greeting). Almost every other states possess various other variables. Some says seriously reduce number of security enjoy in the assets. Browse the BK exemptions to suit your state.

The newest OP is also refi his mortgage several years just after BK in the event that they have re also-depending his credit in which he can show that the repayments was indeed timely. Two years having extenuating get redirected here points.

The mortgage lien stays towards property up until its either paid off, refianced otherwise ended up selling or foreclosed (regarding low-payment).

A HELOC are certainly more hard to find shortly after an excellent BK. The brand new OP could need to refi the complete mortgage so that the the newest financial has actually an initial mortgage.

I’m staying in the home and you can maintaining brand new money. I didn’t reaffirm the borrowed funds for each my attorneys information however, is permitted to excused the new collateral inside your home(I’m during the CT). The brand new trustee said regardless of if my actual security(real estate agent did an effective ount it might cost to offer our home and you may pay back the 1st home loan and down payment guidance mortgage(essentially a 2nd home loan) there would not be sufficient to distribute back at my creditors thus I happened to be able to excused all the equity. I’ve every purpose to the residing in our home for a beneficial long-time(as a result of its paid into the and you will beyond-Everyone loves where I live) I happened to be merely asking in terms of the coming-if it are you’ll be able to- in order to borrow on the fresh equity getting home improvements/maintenance basically wished to. It absolutely was a believed that popped to your my head and i know I decided not to very come across far concrete informative data on this subject everywhere inside my hunt.

Looking at the derogatorty matrix getting BK’s – to your a conventional loan it is 2 yrs off release big date that have extenuating circumstances and you may 4 many years versus extenuating points.

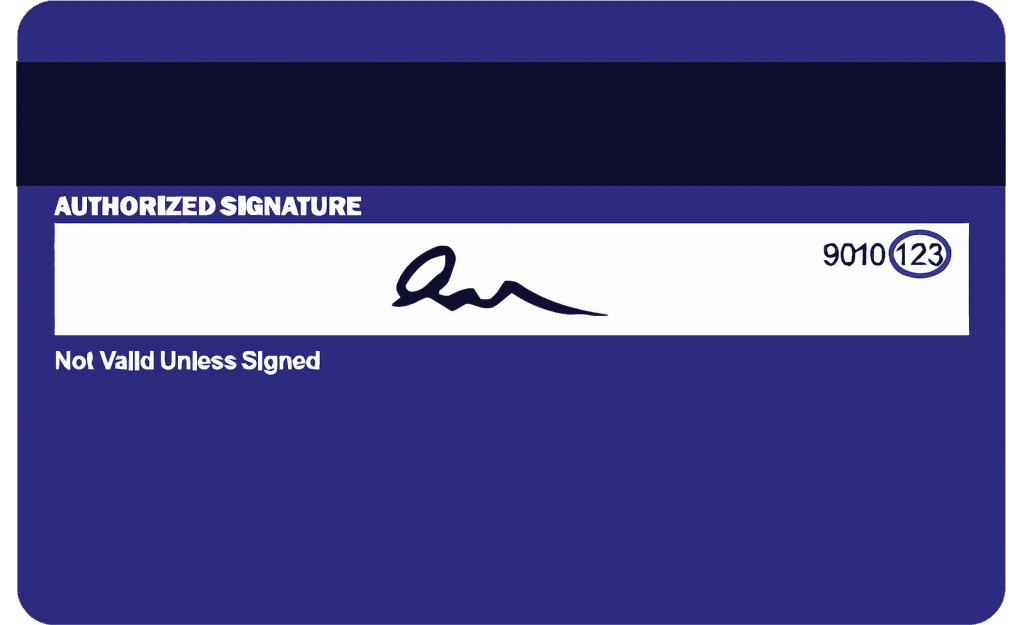

Monitor of any payment you made promptly (terminated view otherwise bank declaration) You should make sure you result in the payments with the otherwise through to the deadline.

Rating Our Software

Even if banking companies enable it to be an excellent fifteen time sophistication months – you’ll find inner specifications for costs made days six-10 and you may eleven – 15 of few days, kwim?

The brand new next away eventually you will get regarding BK the more likely a HELOC is achievable. You may anticipate doing one to shortly after 2 yrs. I do believe would-be tough if you don’t impossible. Immediately after cuatro yrs, perhaps. You’d features finest luck with a smaller bank IMO.

Make sure to wait 4 age plus one day before applying for an alternate financial. The time physique is certain. The brand new time clock begins from your launch date to the new application go out. He could be particular when it comes to the schedules. seems like you probably did best part of preserving your house.

Credit Knowledge

All FICO Score circumstances offered into myFICO include a good FICO Rating 8, that can were more FICO Score sizes. Your financial otherwise insurer can use an alternative FICO Get compared to the versions you get from myFICO, or any other style of credit rating entirely. Learn more

FICO, myFICO, Rating See, The brand new get lenders explore, as well as the Get That really matters is actually trademarks otherwise joined trademarks out of Reasonable Isaac Company. Equifax Credit report are a trademark from Equifax, Inc. and its particular affiliated businesses. Of many points connect with your Credit scores together with interest levels you will get discover. Fair Isaac isnt a cards repair providers since the discussed under government or state laws, including the Credit Repair Communities Operate. Fair Isaac will not offer “credit resolve” features or pointers otherwise direction out-of “rebuilding” otherwise “improving” your own credit record, credit score or credit rating. FTC’s site into borrowing from the bank.