- Active-duty participants and you can experts need to have offered at the least 181 weeks throughout the peacetime otherwise ninety days throughout wartime.

- Federal Protect players need to have served at the least six years of solution regarding the Come across Reserves or Protect otherwise 3 months during the wartime.

- The new Virtual assistant tend to consider the kind of discharge and you can specific affairs around they to choose eligibility.

If you are eligible, you’ll need to score a certificate of Qualifications (COE) regarding the Va to apply for an interest rate.

Of a lot online loan providers, borrowing unions, and banking companies give Va funds. Consider your specific demands when deciding on an educated Va loan lenders. Here are some key factors to remember.

Examine Rates of interest and you can Costs

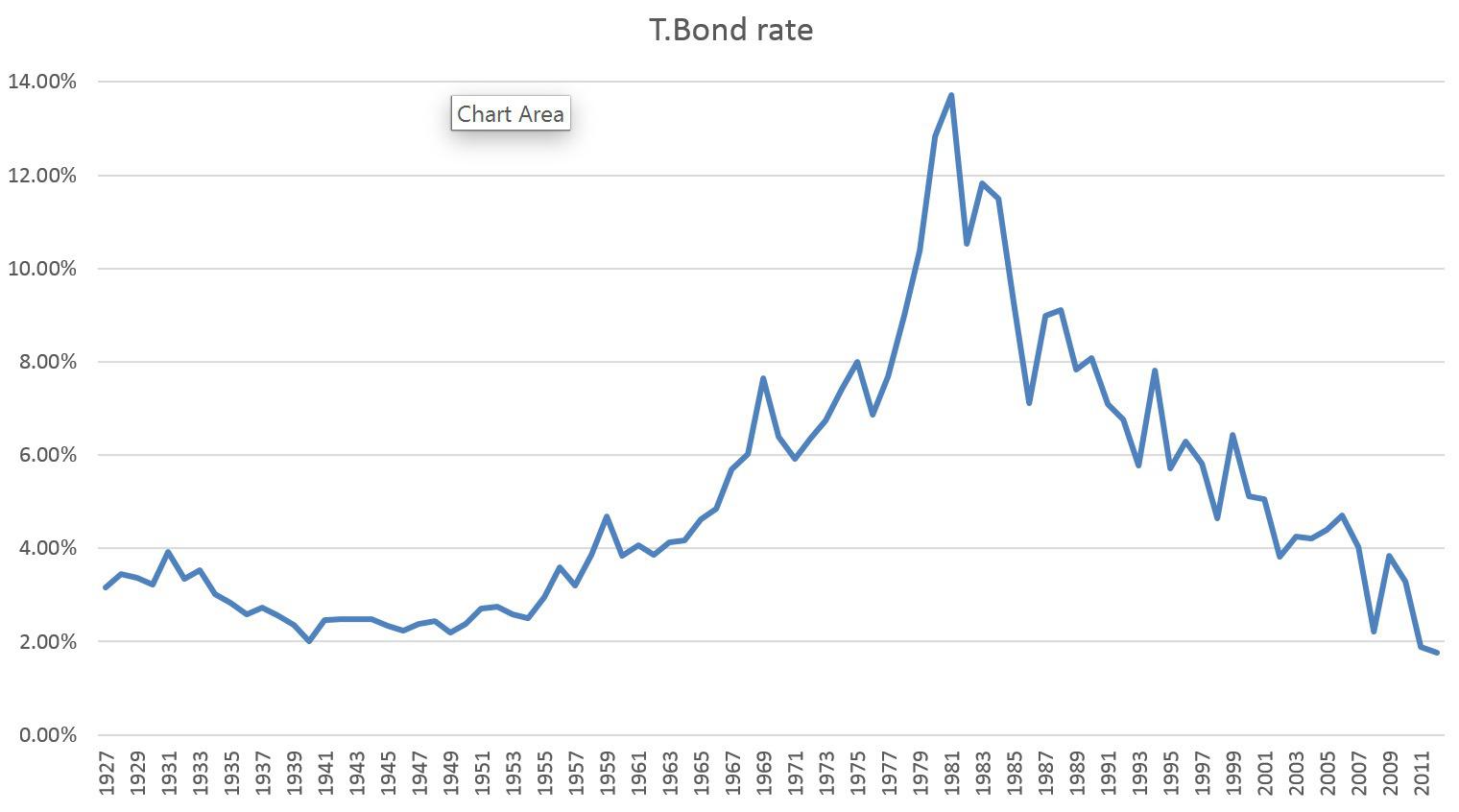

The brand new Va loan pricing you qualify for relies upon good couple items, for instance the most recent economic conditions (upon which new Federal Set aside Lender sets the entire amount of short-title rates), mortgage terminology, your earnings, your own quick assets, and your credit score. If you are you’re going to have to spend Va resource costs with all of Va finance, there are many more will set you back you will need to take into account, for example mortgage origination fees and settlement costs.

Make sure to examine the new apr (APR) of one’s Va financing supplied by other lenders instead of the interest rate once the Apr means the real cost of the brand new loan(s) you’re considering. APRs depict the total mortgage cost into the an annual fee basis, plus most of the financial fees. And since there can be significantly some other fees, costs, and you may financing terminology from mortgage to payday loans online Oklahoma loan, you happen to be ideal in a position to personally examine each loan towards a keen apples-to-apples foundation when using the Annual percentage rate rather than the interest rate alone.

Whether you’re an initial-time homebuyer otherwise refinancing your existing home loan, you will be able to find a reduced interest rate and you will maintain your mortgage repayments affordable if you evaluate at least about three lenders.

Browse Financial Profile

We advice working with Va loan providers which can be experts in its sphere. Find out more about how much time the lender might have been providing Virtual assistant financing and exactly how of many loans they originate yearly. Virtual assistant money are going to be difficult making it far better manage lenders which might be knowledgeable.

You should also take a look at critiques of your lenders online and discover sensation of almost every other consumers to obtain a much better understanding of their characteristics. Make sure the bank is registered to the All over the country Multistate Licensing Program and you can Registry (NMLS).

Check Support service

Mortgages require a number of documentation, and you will Virtual assistant mortgage brokers is generally more complicated because they and additionally cover deciding the fresh new borrower’s military position and you can qualification. An informed Va mortgage brokers gets experienced Virtual assistant mortgage officials who will make the whole financing processes seamless and you will worry-100 % free.

Make sure the financial is not difficult to connect which have, responsive to issues and questions, and will help you obtain authoritative docs for instance the Certification away from Qualification (COE).

Examine Your options To find the best Virtual assistant Financial Merchant

Va lenders give a less complicated road to homeownership getting experts, energetic responsibility solution participants, and enduring spouses. These funds don’t need people down payment and regularly come with really competitive rates compared to other conventional mortgage loans.

Yet not, it is very important know the way Va funds functions, exactly what qualification standards is, and you can what costs are involvedpare several financing selection and study buyers product reviews to find the best Virtual assistant mortgage lender. Most importantly, make sure the monthly payment is affordable.

When you’re there are no minimum credit history standards towards the mortgage system, most lenders gets their unique requirements. You will also must see these types of provider conditions lay because of the VA: