Others choice is good Virtual assistant loan and this needs newest otherwise previous army obligations. Just like any home loan, you’ll find categories of particular conditions that have to be came across ahead of an applicant is approved. USDA Mortgage qualifications criteria into the 2024 has actually several main portion:

Whenever trying to get an effective USDA rural mortgage, the lending company often eliminate this new borrower’s credit file of all the about three credit bureaus. This is named an excellent tri-merge credit report. The lending company after that looks at fico scores while the credit score to decide if your candidate is approved, credit-wise.

To locate acceptance, the fresh borrower should have a center credit rating of at least 620 and now have no late homes payments for around you to definitely seasons. In case your applicant got a bankruptcy or property foreclosure in their earlier, they must demonstrate that an acceptable amount of time has passed since then.

Number 1 Sidebar

- Center FICO credit rating regarding 620 otherwise more than.

- Zero late money during the last 12 months.

- Zero outstanding judgments over the last 12 months.

- All bankruptcy proceeding payments have been made timely over the past season (Part thirteen).

- No less than three years enacted since the a property foreclosure or bankruptcy proceeding (A bankruptcy proceeding).

The original DTI ratio employed by USDA loan certificates is famous since the Best Ratio, or Front Proportion. Which ratio measures the brand new borrower’s complete money resistant to the the fresh new casing commission and principal, notice, taxation and you will insurance (PITI). So you’re able to qualify, the fresh recommended the commission PITI try not to meet or exceed 31% of borrower’s money.

Another DTI proportion, known as the Base Proportion, Right back Proportion or Total Loans, weighs the latest borrower’s complete debt weight, including the brand new construction commission from the borrower’s total income. To qualify, the of borrower’s new suggested month-to-month financial obligation load, along with casing payments, handmade cards, automobile notes and you may student education loans, don’t exceed 42% of their overall reported money.

And because USDA mortgage guidance likewise have restrict limits set for debtor earnings, they have to in addition to reveal that they don’t generate too much money so you’re able to be considered. The greater well-known Part 502 Protected Funds consist of restriction earnings restrictions of 115% off median family earnings into urban area. Restrict income limitations start from condition to county, but the general limit to own children from (4) is just about $112,450 a-year for the majority metropolitan areas. Income restrictions was sustained getting big house of five+ users.

Figuring USDA mortgage earnings qualifications can be a little problematic, making it wise to see an experienced USDA home loan company so you can help. Think about, these types of earnings limitations pass by the users from the home one discover money online personal loans Vermont, not only those making an application for the loan.

Primary Sidebar

- The brand new candidate need a dependable one or two-12 months a career record.

- Brand new applicant need to fulfill USDA debt-to-income standards of using noted income.

- 29% Better Ratio The latest recommended property fee with PITI will most likely not meet or exceed 30 % of your applicant’s combined month-to-month earnings.

- 42% Base Ratio The applicant’s proposed this new monthly overall loans weight, plus the houses percentage, may not surpass 42 percent of their joint monthly earnings.

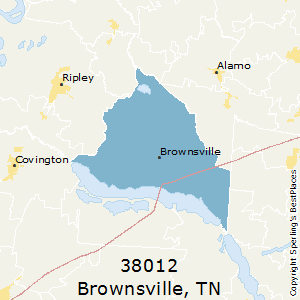

Having a home are entitled to an effective USDA, it needs to be situated in a medication outlying area, just like the laid out because of the USDA. The usage of Rural Urban area could be extremely loose, and there was tens and thousands of places and suburbs out-of metropolitan areas all over America that are entitled to USDA money.

Generally, areas recognized for USDA funds are observed beyond your restrictions out of places and you will places that have a society regarding ten,000 anyone or even more. Functions located in places which have a society away from below ten,000 can also be noticed eligible. To be certain in the event that a house is approved for a great USDA financial, candidates is also see the address of one’s subject assets with the USDA Property Eligibility Website. The subject assets need to citation an assessment review by the an approved appraiser to find USDA funding.

The new assessment standards having USDA loans are particularly just like people getting FHA money. The prerequisites are very equivalent, indeed you to definitely an approved FHA appraiser will perform the brand new USDA possessions appraisal. The newest appraiser make an esteem assessment of the home, and therefore need certainly to surpass it suggested loan amount. They will also look for anything else regarding the house which will cause problems such as for instance structural affairs, a leaking roof, shed color and you will plumbing system issues.

USDA mortgage charges are particularly aggressive when comparing to almost every other low-down-payment mortgage programs. There are 2 fees involved in which have an effective USDA mortgage, each of that’s paid down overtime.

The initial payment is called brand new Beforehand Ensure, that’s thought because of the figuring step one% of recommended loan amount then incorporating one to profile to help you the loan balance to be paid through the years. For example, if the proposed loan amount try $100,000, new Upfront Be sure Percentage was $step 1,000, that is rolling with the dominant equilibrium to own an entire financial quantity of $101,000.

Next payment is the Yearly Fee, and therefore serves in the sense just like the monthly mortgage insurance coverage. The newest yearly percentage are tallied each year of the figuring 0.35% of your own kept dominant harmony. That count will then be divided of the a dozen and placed into per monthly payment.

One of the primary benefits associated with USDA financing ‘s the feature on supplier to pay every settlement costs, thus allowing a buyer to close into property with little so you can No cash up front. To find out more, excite e mail us or simply just fill out the fresh new Quick Request function in this article.

Has actually Issues?

All of our knowledgeable mortgage officials is actually waiting to help you with every of one’s mortgage requires 7 days per week. Excite fill in the fresh new Quick Consult Mode below having any questions.