Within the 2021-2022 Government Budget, the government has actually invested in taking around 10,000 Australians which have help to get the earliest domestic sooner or later.

The first Home loan Deposit Strategy guarantees qualified candidates categorized once the lower and you can middle income’ to shop for a house having a deposit off as low as 5%.

Brand new system allows first homebuyers take out a home loan which have simply a 5% deposit to end paying lenders mortgage insurance (LMI) charges. Prior to now, banking institutions and you can loan providers always want purchasers for 20% of your own property’s worthy of conserved already become exempt of LMI charge. Towards launch of the fresh budget, the federal government have a tendency to underwrite the loan within the scheme to ensure that LMI don’t is applicable.

Into the national acting as your guarantor, it is now in an easier way as acknowledged to possess a home loan in the place of less in coupons. The lender, although not, commonly still perform the typical monitors on the finances.

This new intent about such recent alter should be to succeed much easier for first-time homebuyers so you’re able to secure the financial. To possess house designers, this change to the fresh new deposit matter provides so much more deals so you’re able to go to your build.

Are you presently eligible for the initial Home owner Design?

- Individuals need to be Australian owners who are at least 18 years of age.

- People applying for the fresh strategy is earn a maximum of $125,000 per year, and you can a great couple’s money are a mixed total away from $200,000.

- Couples are only qualified to receive brand new Program if they’re married or even in an excellent de- facto matchmaking. Almost every other people buying to one another, and additionally siblings, parent/youngster otherwise relatives, are not qualified.

- Individuals must have a deposit away from between 5% and you may 20% of your property’s worthy of.

- The brand new design will simply suffice 10,000 programs annually, on the an initial been first serve base.

- Functions which might be getting ordered underneath the program need to be classed because the a keen admission property’ and won’t is higher-worthy of attributes.

- Rates limits decided from the part. An entire list of price limits try intricate less than.

How do i pertain?

Programs into the Very first Domestic Stream Put Plan will be lodged using your chose bank as well as their agents. This new https://availableloan.net/payday-loans-sd/ system does not deal with apps privately.

You can find twenty seven lenders who’re accepted to provide guarantees less than the brand new system; an entire record is obtainable right here.

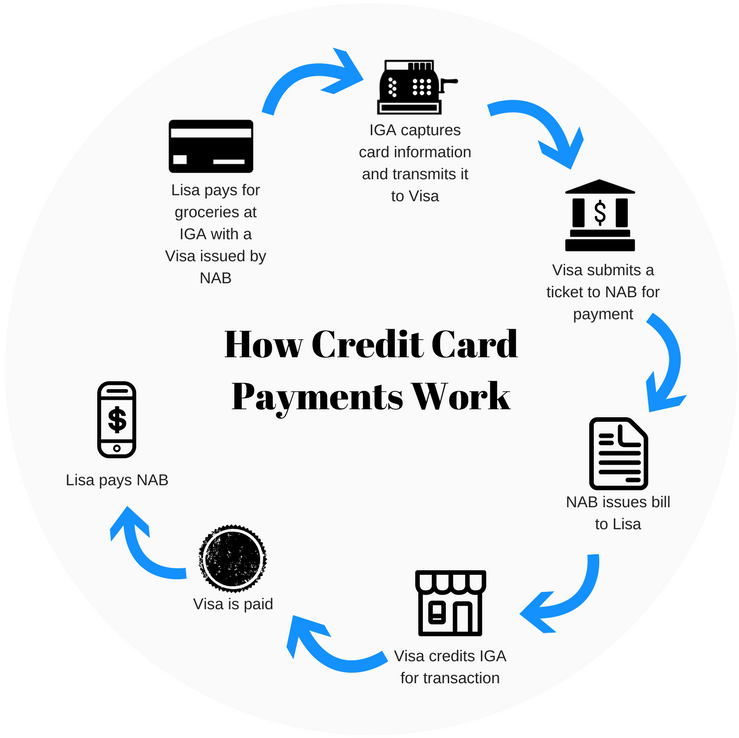

What exactly is financing guarantor?

Financing guarantor was someone who believes to repay brand new personal debt in the event the an effective loanee has in order to standard on the decided costs. In cases like this, the latest guarantor of your home financing ‘s the authorities.

The current presence of an excellent guarantor really helps to make protecting a home loan a smooth processes which means this strategy usually we hope generate household to find even more obtainable to own Australians.

Exactly how much am i going to save yourself towards Very first Home loan Put design?

The federal government states that you might help save to $ten,000 by the failing to pay to own Lender’s Mortgage Insurance coverage. This is an excellent ballpark profile, nevertheless specifics of how much you would help save depends on the fresh ins and outs of the loan. Such issues are loan proportions, put size and bank conditions and terms.

It is critical to remember, that it scheme isn’t the Basic Home Owner’s Offer. The government is not spending money on a fraction of your home but instead making it easier to have homebuyers to locate a beneficial mortgage.

Must i make use of this program together with the Very first Home Owner’s Give?

Sure! You can get this authorities scheme and additionally another plans that is certainly supplied by your state otherwise area. Keep in mind that the newest qualifications criteria may vary between the give and you may program.

The fresh new functions that will be incorporated as part of the system would not have to end up being newly created. While this is an alternative, you can use which scheme to find a current family, townhouse, or flat. You are able to buy property and homes bundle, belongings with an agreement to create otherwise a through-the-bundle apartment otherwise townhouse. These are all you are able to purchasing included in the Basic Mortgage Deposit Design.

Are there risks doing work in delivering a reduced put mortgage?

There are a few dangers that include lowest put lenders. Down deposits suggest individuals usually takes with the far more financial obligation and you can end right up paying back a lot more attract. Which have lower security of your home right away can also result in issues when refinancing or modifying loan providers. Specific loan providers also can promote less competitively cost fund according to your own lower savings.